Creative Disruptors Fund I

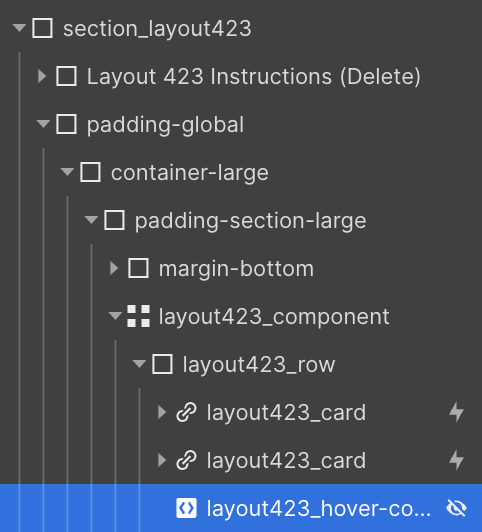

As one of Europe’s few DeepTech Operator VCs, our founder-led team leverages each one’s decades of operational, technical, and financial experience to uncover untapped potential, reduce risk of failure and drive significant growth.

Aiming to defy the "accepted norm", flipping

70% failure, to 70% success rate

Our Thesis

The Creative Disruptors Fund I represents a diversified venture fund primarily focused on Seed/Seed+ investments. The fund's overarching thesis revolves around identifying infrastructure and SaaS applications aimed at reducing friction and enhancing the sustainability of global commerce.

Sectors we invest in:

FinTech

We strategically invest in FinTech, fostering innovation and advancing digital financial solutions for global impact.

Narrow-Focus SaaS

Our focus lies in strategic investments in B2B SaaS, driving growth and innovation in enterprise software solutions.

Supply-Chain-Tech

We invest in Supply Chain Tech, optimizing logistics and revolutionising global supply chains through innovative technological solutions.

Operator VC Benefits

As an operator VC, our team's diverse experience as founders, operators, investors, and technologists provides a distinct strategic advantage. Our deep industry experience, market intuition, and understanding of emerging trends enables us to identify high-potential opportunities. HVL works in partnership with founders, providing the financial rigour and tech power needed to build profitable companies.

Tech/Finance Expertise

We leverage our in-house tech specialist team (100+) and have access to Europe's best tech talent pools. We have built proprietary AI tools to streamline due diligence and enhance the investment selection process. Our custom designed assessment matrix tool ensures consistency and removes bias. Our unique post-investment optimised operational and monitoring framework minimises risk.

92%of European VCs are not operator led!

Our Track Record

Our partners, each a seasoned entrepreneur with a blend of tech and financial acumen, hold an impressive track record as trusted custodians of capital, and in nurturing innovative companies to become industry pacesetters and driving exponential growth.

Our Track Record

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Short heading goes here

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Short heading goes here

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

No. of deal per year

8

No. of follow on deals

3

Allocation Period

3 Year investment period

Management period

7 Years

Target Returns

3.28x MOIC

27.7% IRR

Estimated Fund Life

10 Years

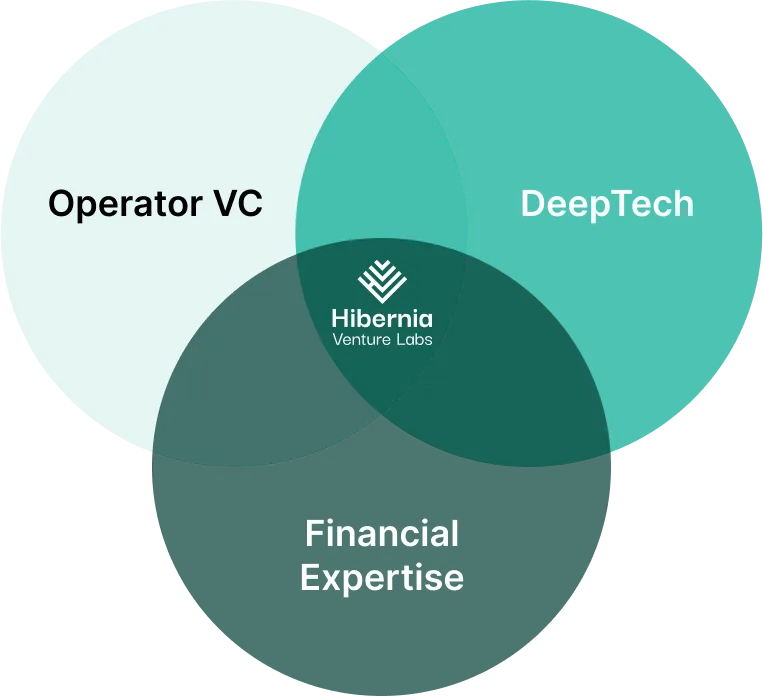

Ireland, UK & Europe

Our operational scope encompasses key geographies, primarily concentrating on Ireland, UK & Europe.

With a strategic focus on the UK & Ireland innovation ecosystems, we aim to cultivate a strong presence and generate impactful ventures within these markets.

This phased expansion strategy ensures a thoughtful and strategic approach to our geographical footprint, aligning with our overarching mission of fostering innovation and sustainable growth.

Unlock Your Potential with HVL

Explore the ways in which Hibernia Venture Labs has already provided value to customers.

Wide Carousel of Services

HVL offers access to a diverse pool of DeepTech, GTM, and Product experts and domain SMEs to draw from.

Preferential Rates

PortCos enjoy preferential rates on essential services provided by HVL through the service co, enhancing their operational efficiency.

Optimized Framework

HVL's integrated approach streamlines operations for PortCos, with post investment real-time monitoring of cashflow, tech, sales milestones, and strategic direction.

Partnership Ecosystem

We have created synergistic, rich and varied ecosystem that supports our investments and internally

incubated assets.

Social Engagement

- Rescued a failed startup resecured from near-insolvency.

- Complete company rebuild, restructure and initialisation done using CFO-as-a-Service.

- Extensive tech build for a social engagement platform, utilising HVL's CTO-as-a-Service.

- Tech-team built platform helping clientonboard 50 enterprise customers inthe US market.

- Raised $1.5m in funding from family office via the HVL network.

AdTech

- Extensive tech build for an AdTech Company, utilizing HVL's CTO as a Service.

- Partnered to increase revenues from €3m to €8m in 9 months.

- Utilized CFO as a Service to restructure and realise tax efficiencies.

- Raised €1m in funding from BlueChip institutions via the HVL network.

Asset Manger

- Responsible for systems that supported ~$2+ trillion AUM as head of Information technology.

- During the tenure of the engagement, AUM increased by ~30%

- Developed & documented technical plan for new near-shore technical team.

- Wholly responsible for all technical DDQ responses for external customer due diligence.

Investment Process

Apply

Evaluation of opportunities using codified AI Opportunity matrix DD tool.

Triage

Prioritization of potential investments based on strategic fit and viability.

Analysis

In-depth assessment of selected opportunities.

Memo

Compilation of findings & recommendations for the Committee.

Committee

Presentation and discussion of investment proposals.

Due Diligence

Due diligence process to validate investment thesis and assess risks.

Invest

Execution of investment agreements.

Support

Active engagement and support for portfolio companies.

Exit

Strategically manage exits and maximize returns for investors.

General Partners

Join us today!

Let's explore opportunities together – schedule a meeting to dive deeper into our investment deck and discover how we can collaborate for mutual success.

Contact us today!

Join us in reshaping the world.